How To Figure Taxes On Paycheck In Texas

There is only one state payroll taxunemployment insurance and it is paid by the employer. Latest W-4 has a filing status line but no allowance line.

New Tax Law Take Home Pay Calculator For 75 000 Salary

After a few seconds you will be provided with a full breakdown of the tax you are paying.

How to figure taxes on paycheck in texas. Determine taxable income by deducting any pre-tax contributions to benefits. Your tax rate is calculated using several factors and can change each yearthe minimum tax rate is 036 and the maximum rate is 636 in 2019. Calculate your fiscal year 2021 take home pay after federal Texas taxes deductions exemptions and tax credits.

Check out our new page Tax Change to find out how. Nexus for franchise tax reports due on or after Jan. To use our Texas Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Taxpayers can choose either itemized deductions or the standard deduction but usually choose whichever results in a higher deduction and therefore lower tax payable. The result is net income. The employer calculates federal payroll taxes according to the Internal Revenue Services guidelines and state payroll taxes according to the Texas Workforce Commissions instructions.

Texas has no state income tax which means your salary is only subject to federal income taxes if you live and work in Texas. The Interest Tax is calculated according to Commission Rule. As of 2021 income taxes at the federal level can be in the range of 0-37.

That means that your net pay will be 45705 per year or 3809 per month. Using our Texas Salary Tax Calculator. Free Federal and Texas Paycheck Withholding Calculator.

Withhold all applicable taxes federal state and local Deduct any post-tax contributions to benefits. This free easy to use payroll calculator will calculate your take home pay. For a single taxpayer a 1000 biweekly check means an annual gross income of 26000.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Does Texas have income tax. This Texas hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Texas tax is calculated by identyfying your taxable income in Texas and then applying this against the personal income tax rates and thresholds identified in the Texas state tax tables see below for currect Texas State Tax Rates and historical Texas Tax Tables supported by the Texas State Salary Calculator. Your average tax rate is 169 and your marginal tax rate is 297. 1 2020A foreign taxable entity with no physical presence in Texas now has nexus if during any federal accounting period ending in 2019 or later it has gross receipts from business done in Texas of 500000 or more.

The state of Texas may be big but its list of payroll taxes is small. 124 for social security old-age survivors and disability insurance and. Texas Unemployment Insurance UI is paid on the first 9000 in wages you pay each employee every calendar year.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. To figure out your Effective Tax Rate simply add these 5 components. Texas has a 625 statewide sales tax rate but also has 815 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1368 on top of the state tax.

The self-employment tax rate is 153. Yep theres not even state income tax in the Lone Star State As an employer youll pay Texas Unemployment Insurance UI on the first 9000 of each employees wages each year. The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962.

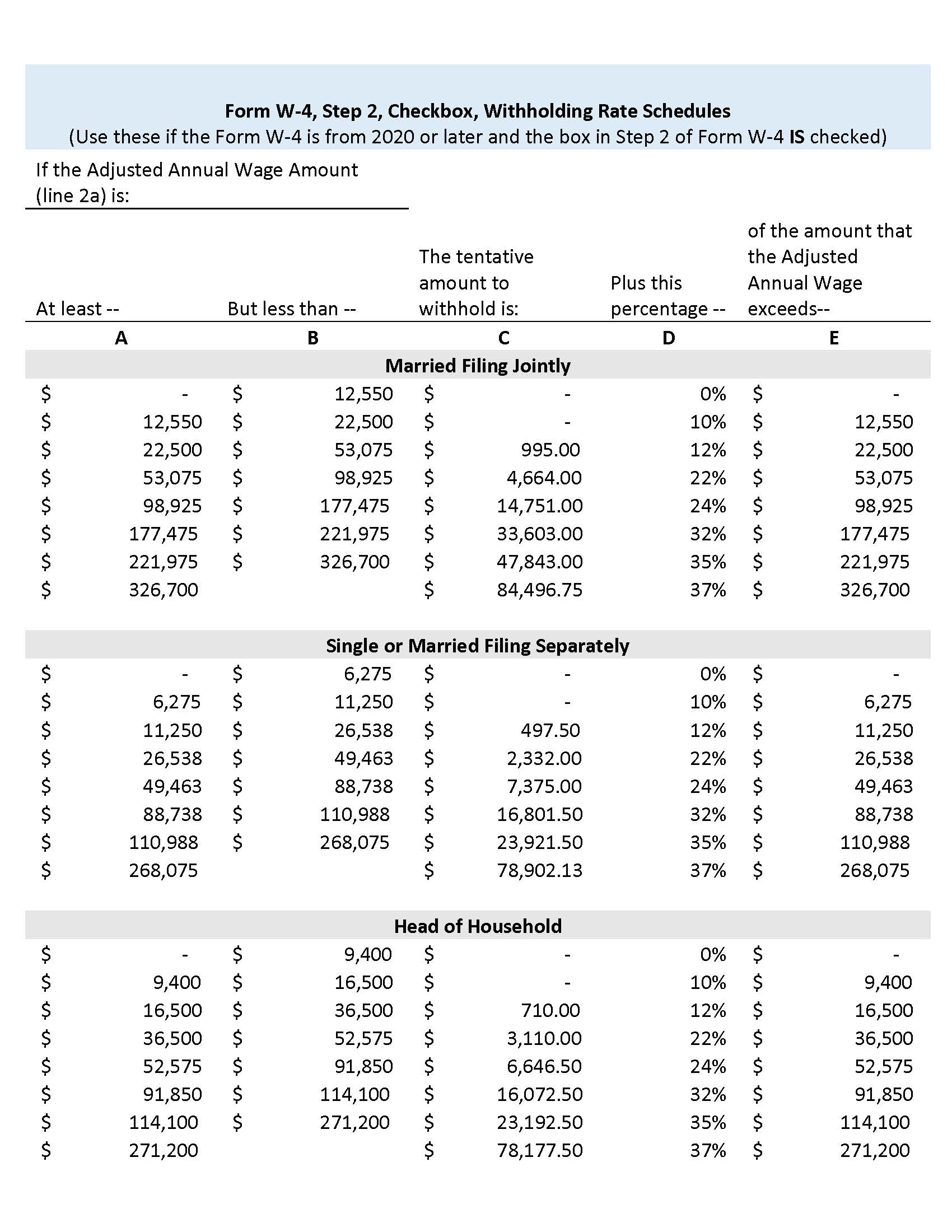

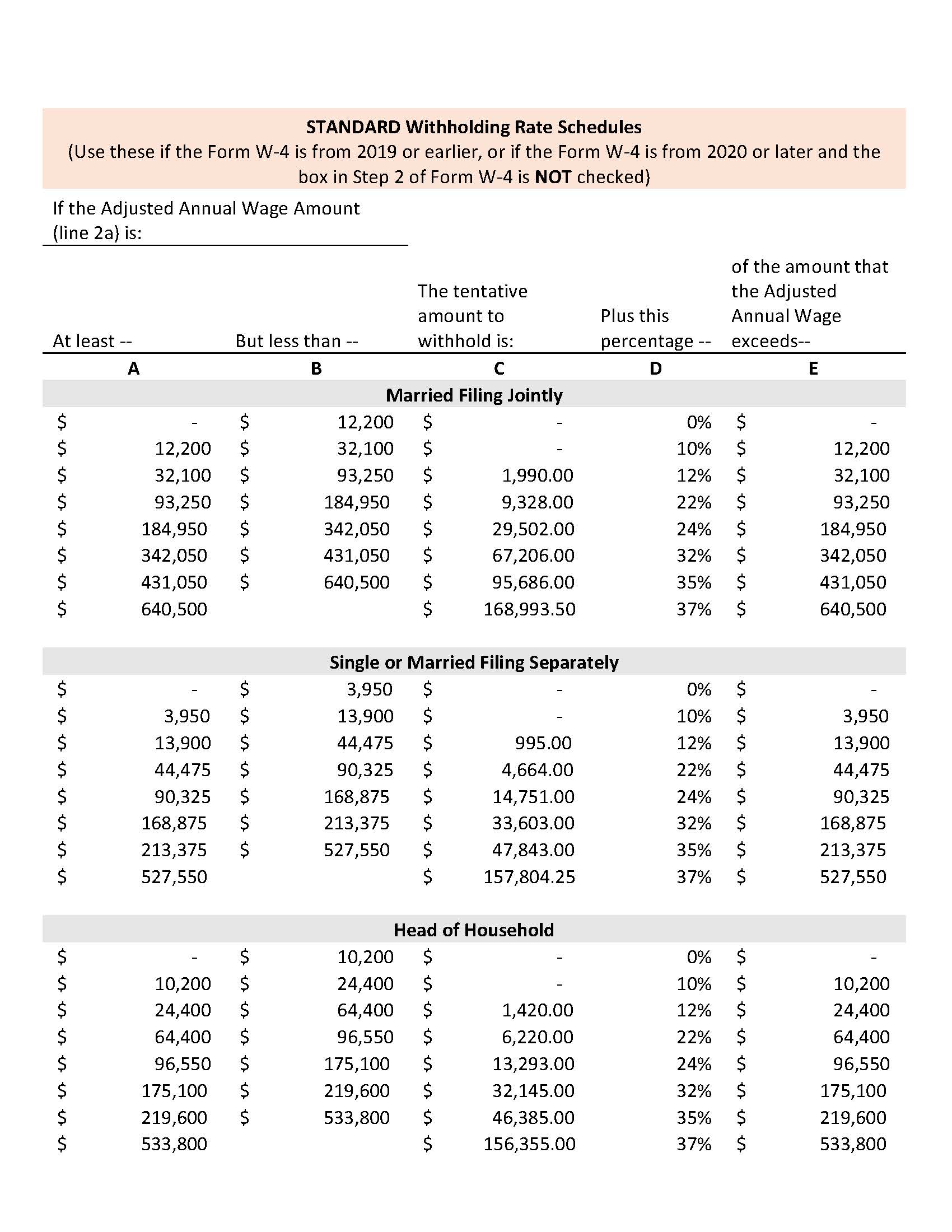

This marginal tax rate means that your immediate additional income will be taxed at this rate. Garnish wages if necessary. Your employees must withhold an amount for their income tax depending on their withholding selections in the IRS Form W-4.

There are no cities in Texas that impose a local income tax. Texas Hourly Paycheck Calculator. If a taxpayer claims one withholding allowance 4150 will be withheld per year for federal income taxes.

Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. The Interest Tax Rate for 2021 is 003 percent. General Tax Rate GTR Replenishment Tax Rate RTR Obligation Assessment Rate OA Deficit Tax Rate DTR Employment Training Investment Assessment ETIA.

The Comptrollers office has amended Rule 3586 Margin. The Interest Tax Rate is used to pay interest on federal loans to Texas if owed used to pay unemployment benefits. Calculate state unemployment tax.

The first of two federal payroll taxes that employees in Texas need to pay are federal income taxes. Ad Payroll So Easy You Can Set It Up Run It Yourself. Texas has only one state payroll tax and its paid for by the employer.

The Texas Workforce Commission advises the employer of its SUTA tax rate for the year. No Texas does not collect personal income tax from residents. How Your Paycheck Works.

Taxes Paid Filed - 100 Guarantee. The exact tax rate is specific to your business and may change. How to calculate Texas State Tax in 2021.

Supports hourly salary income and multiple pay frequencies. This percentage will be the same for all employers in a given year. The standard deduction dollar amount is 12550 for single households and 25100 for married couples filing jointly for the tax year 2021.

For both salary and hourly jobs. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. The rate consists of two parts.

If you make 55000 a year living in the region of Texas USA you will be taxed 9295. Instead you fill out Steps 2 3 and 4.

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Payroll Tax What If Employer Didn T Pay Withheld Tax To Irs Payroll Taxes Tax Services Payroll

Texas Paycheck Calculator Smartasset Com Property Tax Paycheck Payroll Taxes

Personal Financial Literacy Texas Teks 5 10a Taxes With Projects Personal Financial Literacy Financial Literacy Literacy

Payroll Tax What It Is How To Calculate It Bench Accounting

Texas Property Tax Calculator Smartasset Com Property Tax Tax Calculator

Texas Paycheck Calculator Smartasset

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Salary Paycheck Calculator Payroll Calculator Paycheck City Payroll Paycheck Salary

Understanding Your Paycheck Credit Com

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Do You Know How Much You Pay In Federal State And Local Taxes Bean Counter Tax Federal Income Tax

How Much You Really Take Home From A 100k Salary In Every State Salary Income Tax Tax

Pin By Klara De Ramirez On Accounting In 2021 Payroll Taxes Savings Calculator Llc Taxes

Texas Paycheck Calculator Smartasset

Here S How Much Money You Take Home From A 75 000 Salary

57 000 Income Tax Calculator Texas Salary After Taxes Income Tax Payroll Taxes Federal Income Tax

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Property Tax Retirement Strategies

Posting Komentar untuk "How To Figure Taxes On Paycheck In Texas"