How To Protest Taxes In Dallas County

In most cases you have 30 days from the date you received your appraisal to fight it. Those are good odds for gamblers Lieber says.

What Are The Advantages Of Homesteading Your Property In Certain States Homeowners Can Take Advantage Of What S Cal Property Tax Homeowner Republic Of Texas

To do so you must file an oath attesting to your inability to pay the taxes in question and argue that prepaying the taxes restrains your right to go to court on your protest.

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/6V7YQHOIQJ23WBLXAJ4MYNJQ2M.jpg)

How to protest taxes in dallas county. Dallas County property owners protested the noticed value for 79490 houses and 138290 commercial and BPP properties. The clock is ticking if you want to protest your property tax appraisal. Informal Property Tax Protest with Reduction.

That satisfies the legal requirement of filing a protest. Everyone has the option of protesting their property taxes every year but many dont because theyre unsure of how to do so. LamarCAD Value reduction resolved though informal process in 2017.

To share this knowledge Lieber has a few how-tos on addressing a protest. This wont help you this year the deadline to file a protest was May 31 in Dallas County. As a Certified Public Accountant and investor the founder realized that one of the biggest costs and most important aspects of owning Texas property is often overlooked and rarely discussed.

But the bill is currently stuck in committee. The appraisal district is a political subdivision of the State of Texas. The researchers conducted their experiments in Dallas Countythe second largest county in Texas with a population of about 26 million.

The number one thing that you should do is take your value notice turn it over fill the thing out and mail it in. Value of Other Accounts Resolved at Informal Protest. In Dallas County you can write a short letter addressed to the chairman of the ARB stating that you wish to protest under 2525 d as the tax assessed value of the property is X of your purchase price.

Dallas County tax protests. Be sure to include your settlement statement HUD-1 to show proof of purchase price. A University of Texas at Dallas study last year of almost 80000 Dallas County homeowners found a typical protester if they win saves 600 in.

Given that the state has no income tax property taxes provide a large source of revenue. Value of Houses Resolved at Informal Protest. Property Tax LookupPayment Application.

On the property page theres a link for uFile Online Protest. That legislation would limit the amount an appraisal could jump in a year to 5 if you have a Homestead Exemption. Property owner property tax protests in Dallas County results in savings of 4034 million in 2018 or 2917 per account protested.

The ARB will not accept protest filings by facsimile or e -mail submissions. Without one the cap would be 10. For example in Dallas County.

I have experience helping hundr. Dallas County Appraisal review Board appeals were successful for 45 of the owners. How Do I Protest Dallas County Property Taxes.

Each county appraisal district has its own setup so I wont generalize. The 2018 budget for the Dallas Appraisal District was. In 2020 a University of Texas at Dallas study of almost 80000 Dallas County homeowners found that a typical protester if they win saves 600 in taxes.

You may ask the court to excuse you from prepaying your taxes. This is the most important step you can take towards ensuring a successful protest. The study also found that 1 out of every 2 protesters won.

Filing a protest can be done through an appraisal districts website or in writing but not usually by email or fax. But heres a clip-n-save for next year on what worked for me. Request the House Bill 201 Evidence packet.

The deadline to file your protest for the 2009 season is June 1st. Texas Tax Protest was founded in 2010 with the mission of making the property tax appeal process easier. When filing your protest you want to fill out that you are protesting based on market value as well as unequal appraisal.

This program is designed to help you access property tax information and pay your property taxes online. Dallas Central Appraisal District DCAD is responsible for appraising property for the purpose of ad valorem property tax assessment on behalf of the 61 local governing bodies in Dallas County. If youre unacquainted with the Dallas County Appraisal District website the easiest way to protest your taxes is by clicking on Search Appraisals on the DCAD home page menu and then searching for your properties by address or under the owners name.

Beginning on April 15 for residential andor commercial or May 15 for business personal property protests to the Appraisal Review Board ARB can be filed by electronic communication via the DCAD website using the. The Dallas Central Appraisal District noted at its website DCAD encourages all property owners and agents to conduct business using DCADs Online Programs which allows the electronic filing of Homestead Exemption Applications and the uFile Online ProtestSettlement system for. As soon as I got my notice I went.

The Dallas Central Appraisal District DCAD prefer that all property would owners file their protest using DCADs uFile Protest and Settlement System uFile System instead of visiting our office to speak with an appraiser or mailing in a protest. How to protest your 2021 Texas property tax appraisal why you should and whats new this year. The Everybody file a protest campaign launched by The Watchdog at The Dallas Morning News is a creative way for Texas property owners to try to.

Dallas County Appraisal District How To Protest Property Taxes

How To Protest Your Property Taxes In Texas

How To Protest Property Taxes In Dallas Collin Tarrant Collin County Save

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Tax Lawyer

Affidavits Of Heirship In Texas Republic Of Texas Texas Legal Documents

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/6V7YQHOIQJ23WBLXAJ4MYNJQ2M.jpg)

Here S How I Knocked 13 000 Off My Property Tax Appraisal In 30 Minutes

Dallas County Appraisal District How To Protest Property Taxes

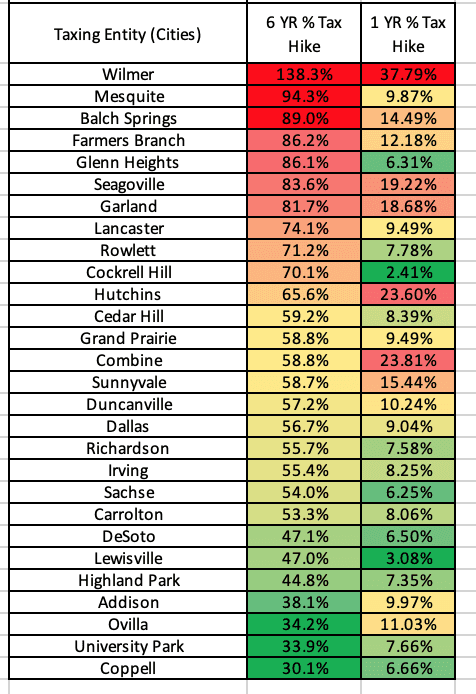

A Taxing Problem Dallas Property Taxes Squeeze Middle Class While Wealthy Businesses Reap Advantages

Quick Setup To Get Your Collin County Sold Comparables To Protest Dfw Property Taxes Grab Our Cheat Sheet Teamduffy Com Pr Property Tax Tax Protest Tax Season

6 Tips To Reduce Property Tax How To Reduce Property Tax Steps To Reduce Property Tax Tips To Reduce Property Tax Tax Reduction Property Tax Tax Consulting

Texas Property Tax Appeals Steps How To File A Property Tax Protest

How To Argue Down The Value Of Your Home D Magazine

Will Cities In Dallas County Lower Property Tax Bills Texas Scorecard

Do All Wills In Texas Have To Be Probated Probate Living Trust Tax Protest

Carlson Property Tax Dallas Property Tax Protest Property Tax Appeal

What Are The Advantages Of Homesteading Your Property In Certain States Homeowners Can Take Advantage Of What S Cal Property Tax Homeowner Republic Of Texas

Cadilac Law Pllc For More Information Please Call Us Now At 972 845 1200 Www Cadilaclaw Net Subscribe Https Www Youtu Business Help Law Firm Tax Protest

Posting Komentar untuk "How To Protest Taxes In Dallas County"