Dallas County Property Tax Lookup

Office Hours are Monday through Friday from 8am to 430pm. For example oak in the street name to find all streets with oak somewhere in the name.

The Ultimate Guide To Real Estate Taxes Anderson Business Advisors Asset Protection Tax Advisors

If searching for a one letter street name such as XY or Z street you must add the wildcard after the letter.

Dallas county property tax lookup. Ad Find Dallas County Property Tax Info For Any Address. Incorporated Assumed Name forms are no longer recorded locally with the County Clerks Office. This site was created to give taxpayers the opportunity to pay their taxes online.

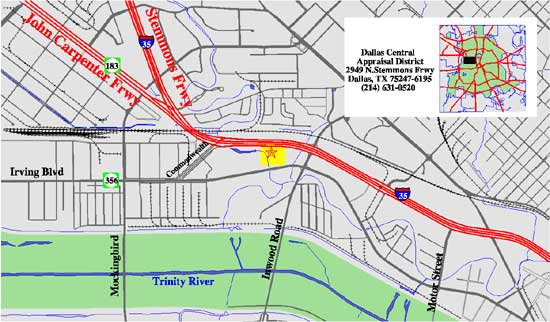

If we buy or sell a home in mid-year who is responsible for the taxes. It is the taxpayers responsibility to keep the Dallas Central Appraisal District DCAD informed as to where the tax bill is to be mailed. Our duties include establishing and maintaining accurate property values for.

Click the BLUE property address link to view the details of your account. Search for parcel information using one of the formats in these examples. Contact the Customer Care Center at 214-653-7811 Monday through Friday from 800 am.

Search by owner name and account type. Refer to your closing papers or call your title company or real estate agent to determine your agreement. As your Dallas County Collector Sheryl Ferrell I would like to welcome you to this website.

Responsible for reviewing and placing values on property. Conference board guidelines can be found here. Parcel numbers can be found on the taxpayers Property Tax Statement.

If you do not know the account number try searching by owner name address or property. Dallas County is a county located in the US. - 430 pm Monday - Friday except for Court Approved Holidays Due to recent legislative changes House Bill 3609.

The Dallas County Assessor determines property values and provides notification to property owners. The County Collector is a. Responsible for processing land transactions that convey property and plotting them on the tax mapsMaps are plotted from the legal descriptions.

The Dallas County Tax Office is committed to providing excellent customer service. Enter at least the first two letters of the last name in the format Last name space first name. They are filed with the office of the Secretary of State only.

In addition our Customer Care Center can answer your questions and provide you with various documents for both property tax and motor vehicle concerns. The appraisal district is a political subdivision of the State of Texas. Bills are mailed to the last known address.

Welcome to the Dallas County Tax Collector ePayment Service Site. Its county seat is Dallas which is also the third-largest city in Texas and the ninth-largest city in the United States. The county conference board consists of the mayors of all incorporated cities whose property is assessed by the county assessor one representative from the board of directors of each high school district who is a resident of the county and members of the county board of supervisors.

00000776533000000 Property Address. The City of Garland commercial customers can pay taxes online find out where. 801 Court St Room 102 Adel IA 50003 515-993-5808.

Tax Rate Per 100 Assessed Value. 2021 Proposed Property Tax Rate. We at the County Collectors Office strive to provide the best service to the taxpayers of Dallas County.

The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700Dallas County collects on average 218 of a propertys assessed fair market value as property taxDallas County has one of the highest median property taxes in the United States and is ranked 194th of the 3143. For a faster search. Account Number May be a 17 character alphanumeric or numeric identifier Example.

Account numbers can be found on your Tarrant County Tax Statement. It is the second-most populous county in Texas and the ninth-most populous in the United States. All Years 2020 2019 2018 2017 2016 2015.

Go to the Property Tax LookupPayment Application contact your local Appraisal District or call 214-653-7811. I hope you find this website useful and convenient. Dallas County Texas Property Taxes - 2021.

Terms and conditions Contact us 2021 Tyler Technologies. Use as a wildcard. As a property owner in Dallas County you should be aware of the following requirements.

The Dallas County Tax Office bills and collects all property taxes for the City of Irving. 214 653-7099 Fax. Taxpayers may enter in the parcel numbers they would like to pay or search by name andor address to retrieve parcel numbers.

As of the 2010 census the population was 2368139. Last Name or Business Name. Dallas Central Appraisal District DCAD is responsible for appraising property for the purpose of ad valorem property tax assessment on behalf of the 61 local governing bodies in Dallas County.

Texas Property Tax Records Texas Property Taxes Tx

Texas Property Tax Records Texas Property Taxes Tx

Dallas County Arrest Court And Public Records

Texas Property Tax Records Texas Property Taxes Tx

Property Search Tarrant Appraisal District

Today Is The Last Day That Duncanville Police Department Facebook

Texas Property Tax Records Texas Property Taxes Tx

Dba Dallas County Fill Out And Sign Printable Pdf Template Signnow

Tax Rates Richardson Economic Development Partnership

Parker County Texas Property Search And Interactive Gis Map

Tax Information City Of Sachse Official Website

Texas Property Tax Records Texas Property Taxes Tx

County Clerk Property Fraud Alert

Delinquent Property Taxes Dallas County Texas Learn About Dallas County Property Taxes Now Tax Ease

Texas Property Tax Records Texas Property Taxes Tx

Posting Komentar untuk "Dallas County Property Tax Lookup"