Taylor County Texas Property Tax Payment

The median property tax also known as real estate tax in Taylor County is 136600 per year based on a median home value of 8990000 and a median effective property tax rate of 152 of property value. The median property tax in Taylor County Texas is 1366 per year for a home worth the median value of 89900.

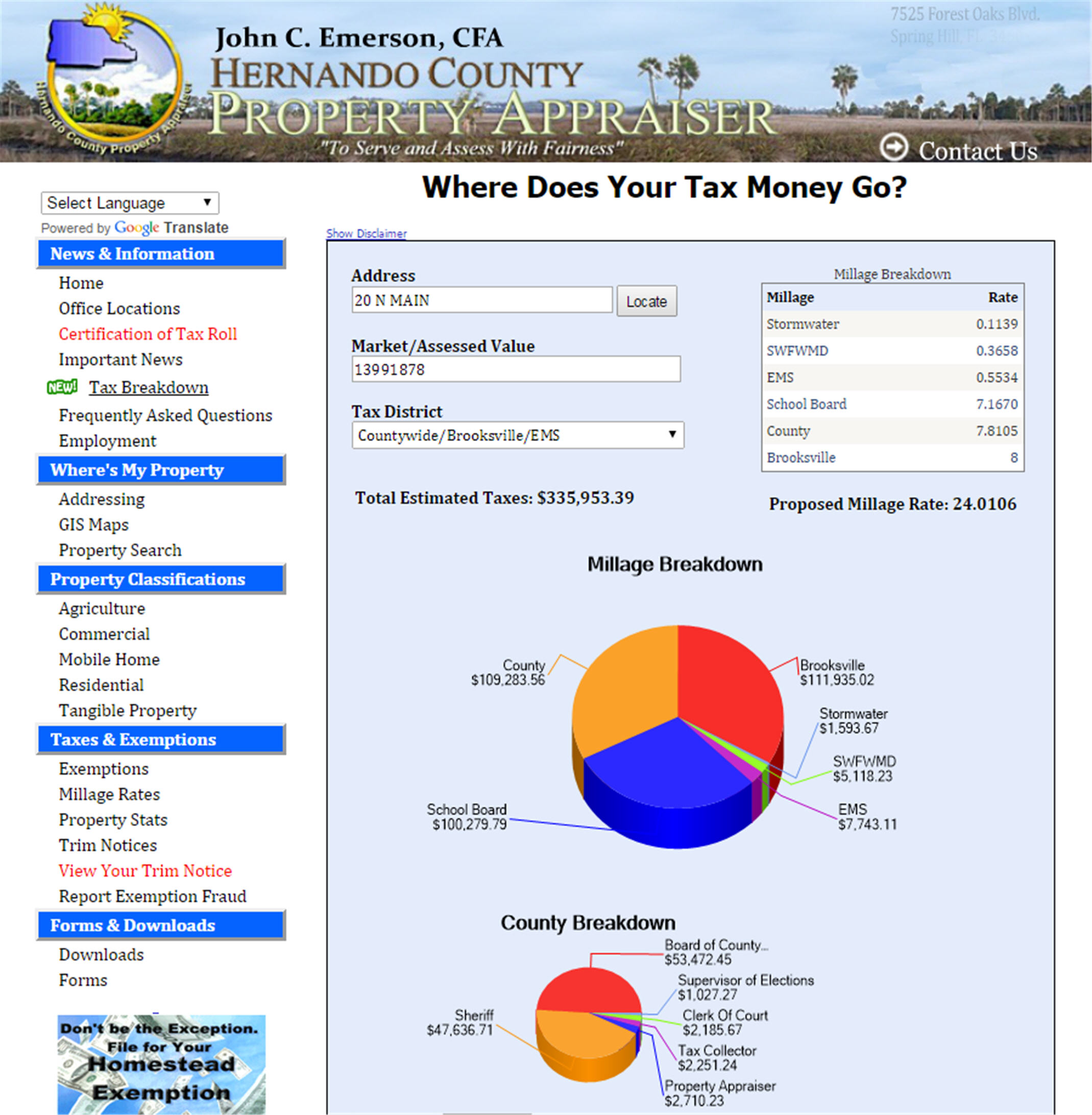

Hernando County Property Appraiser

Property Tax Taylor ISD per 100 14700.

Taylor county texas property tax payment. County departmental information with addresses phone numbers and e-mail addresses. Refund of Overpayments or Erroneous Payments Section 3111. CONCEALED WEAPON APPLICATIONS CALL 850-838-3580.

OR Taxes may be paid by creditdebit cards or e-check by calling 1-866-549-1010. Box 189 Grafton WV 26354 304 265-5766. Taylor County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections.

Suite 110 Abilene TX 79602 Sparky Dean. To view the Texas Property Tax Code in its entirety visit the Texas Window on State Government Web site. You can then check the tax years you want to pay.

For your convenience we have listed links for. Deferred Collection of Taxes on Residence Homestead of. Treadaway Abilene TX 79602-4927.

Tax statements are normally mailed on or before November 1st of each year. There is a 4 fee. If this property is not located within Taylor County the appraisal information is not updated for the current year.

Weve been awarded the Certificate of Excellence in Assessment Administration by IAAO. City of Taylor and Williamson County Tax Rates. Fill in the appropriate.

You may pay all years due or make a partial payment of your taxes. Once you have located the property you want to pay you may click the pay taxes button at the top left of the screen. SEE Detailed property tax report for 1101 N Judge Ely Blvd Taylor County TX.

The full amount is due by March 31st. The tax notices are sent to the owners last address as it appears on the tax roll. The amount due will show in the payment box or you can make a partial payment by typing another amount in the payment box.

Our office accepts cash. Property Tax Code Reference. Notice of Tax Rate Hearing August 31 2021.

WE ARE TAKING APPOINTMENTS FOR. The Texas Tax Code establishes the framework by which local governments levy and collect property taxes. Please contact the county where the property is located for current information.

Total Sales and Use Tax. Credit Card Payments can be made through Certified Payments by either going to the website. 2016 Property Tax Information News Release.

Ad Search County Records in Your State to Find the Property Tax on Any Address. Please make sure you have received a confirmation number in order to insure that the payment process is complete. Driver License Renewals Written Driver License Tests CDL.

FAQs How much is the convenience fee for paying property taxes with a credit card. Within this site you will find general information about the District and the ad valorem property tax system in Texas as well as information regarding specific properties within the district. Order Setting Tax Rate for Tax Year 2021 for Maintenance Operations and Interest Sinking.

State Sales and Use Tax. Enter an Address to Receive a Complete Property Report with Tax Assessments More. Taylor County Sheriffs Tax Office PO.

Wayne County Kiosk Program. There is a 4 fee. Delivery of Certain Notices by Email.

Unpaid balances will be subject to penalties and interest. If you do not receive a bill in November call our office at 850-838-3580. Welcome To Taylor County Central Appraisal District.

Wayne County Treasurers Office is accepting payments for delinquent taxes on the all-new DTE Kiosk Network. Texas is ranked 950th of the 3143 counties in the United States in order of the median amount of property taxes collected. Taylor County collects on average 152 of a propertys assessed fair market value as property tax.

When the amount you want to pay shows in the payment box click proceed to payment cart. Precinct Judges Mike McAuliffe Justice of the Peace Precinct 1 Place 1 450 Pecan St. Tax Deferral Affidavit for Over-65 or Disabled Homeowner.

Treadaway Abilene Texas 79602 PAY NOW Pay your Taylor County Texas property taxes online using this service. Please do not send cash through the mail for payment. Usually county governments impose the largest taxes and often there are additional taxes imposed by.

2020 BPP Depreciation Schedule. Property Tax Williamson County per 100 0459999. Local Sales and Use Tax.

Box 1800 Abilene TX 79604-1800. Notice of Adopted 2021 Tax Rate Adopted FY2022 Budget. Personal property taxes and water bills may be paid online for an additional fee using the Official Payments Service.

We are located at 400 Oak St in the Taylor County Plaza building. Bureau code is 2228888. Property Tax City of Taylor per 100 0813893.

FMRD Williamson County per 100 0030000. Appraisal Protests and Appeals. Texas Property Tax Basics.

OConnor represents taxpayers in filing property tax protests against appraisal districts to secure lower property taxes. Taxpayers can make payments and look up account details research tax information pay. 2021 BPP Depreciation Schedule.

Partial payments will be applied on a pro-rata basis to tax penalty interest and collection penalty if applicable. OR Taxes may be paid on-line by credit card or e-check no convenience fee for e-check by accessing the Property Balances page. Property Tax Concealed Weapons Renewals Business Tax Tourist Development.

You can mail registration renewals to. Property Tax - Total. Provide payment in full in the form of a money order cashiers check or company check made payable to the Justice of the Peace of the proper precinct.

Pin By Gvanwage On Lawyers Title Frisco Tx 75034 Title Insurance Dfw Real Estate Best Titles

Sale Of Loise For Owner S Back Taxes July 25 1849 Tslac African American History Texas History History Lessons

The Best And Worst U S State Economies Vivid Maps Economy Infographic Infographic States

Master Plan Cypress Creek Lakes Master Plan Consists Of Approximately 1 600 Acres That Will Ultimately Provide Approximately Cypress Master Plan How To Plan

Growth Seen In Preliminary Property Values

3 Day Eviction Notice Real Estate Forms Consent Letter Sample Real Estate Forms Resignation Letter Sample

Nice Map Of Fort Worth Texas Fort Worth Map Dallas Map Map

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

8 Things To Do After Closing Real Estate Buyer Packet Diy Etsy Real Estate Buyers Real Estate Marketing Plan Real Estate Tips

Taylor County Appraisal District How To Protest Property Taxes

Rhode Island Map Rhode Island History Rhode Island Island County

Property Data Online Jackson County Oregon

Heating And Ac Facts Hvac Hvac Humor Heating And Air Conditioning

Assessor S Department Parcel Search

Hernando County Property Appraiser S Office

Kaufman County Property Tax Records Kaufman County Property Taxes Tx

Pay Property Taxes Blanco County Appraisal District

You Buyer Appraiser Bank Inspector Tax Assessor Realestate Value Collage Laugh Of The Day Re P Ohio Real Estate Real Estate Fun Real Estate Memes

Mall Map For Allen Premium Outlets 174 A Simon Mall Located At Allen Shopping Center Outlet Mall Map

Posting Komentar untuk "Taylor County Texas Property Tax Payment"